Risk Management Simplified: A quick Overview to Managing Risks

For simplified risk management to be effective, organizations must seek to influence future outcomes through proactive instead of reactive behaviors. When done correctly, it will lower the likelihood of a risk occurring while alleviating its impact if it does.

Information security has become a vital function for all businesses, even more so in light of digital transformation initiatives and the emergence of stricter data privacy regulations.

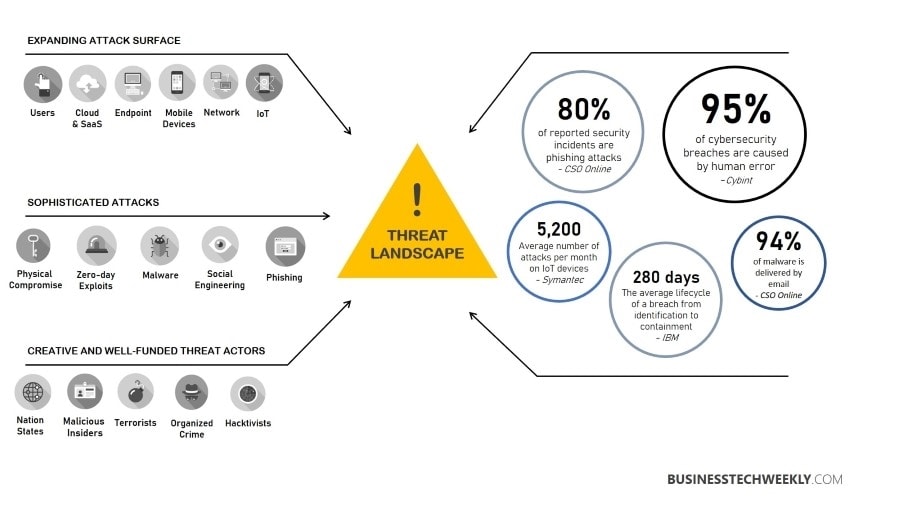

Cyberattacks remain the primary danger to corporate data and information. Unsurprisingly, the first step in fighting these attacks is identifying the source and attempting to halt the attack in its tracks.

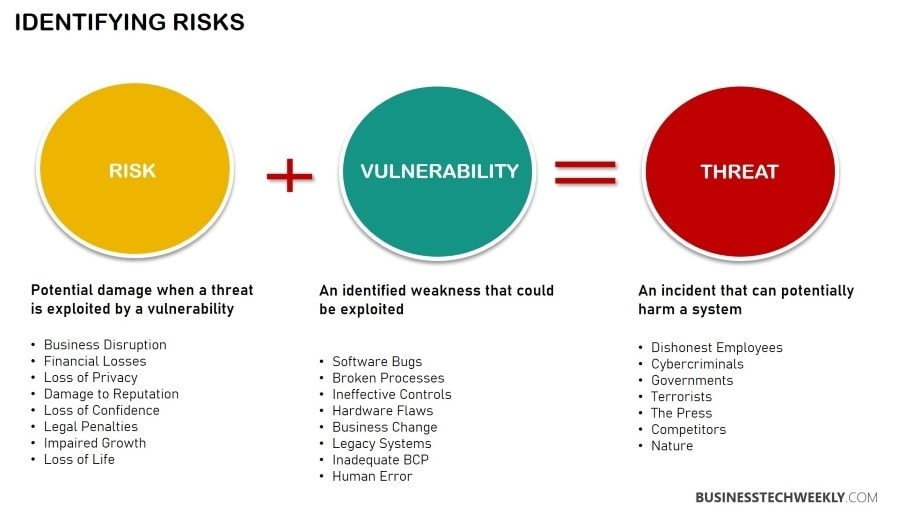

Risk and vulnerability assessments are the two methods used in information security to comprehend principal threat sources.

Both are critical in establishing the origins of threats to the confidentiality, integrity, and availability of information and the most suitable course of action for detecting, preventing or combating them.

On this page:

Risk Management Simplified: Understanding how Risk Assessment Works

Risk management encompasses identifying, assessing, and controlling potential threats to institutions or their resources. These hazards could arise from several sources, including legal liability, natural disasters, accidents, financial disruptions and errors regarding strategic management.

In particular, IT (Information Technology) threats have become of great concern, especially for digitized companies. As such, contemporary risk management plans usually encompass procedures for identifying and controlling threats to digital resources, including customer data, intellectual property, and proprietary company assets.

Also read: Business continuity and crisis management

Regardless of what sector you operate in, there are threats which if manifested, can cost a significant amount of money, reputation or goodwill, potentially leading to its demise. The purpose of risk management is to recognize and neutralize these threats before they occur.

How to Assess Risk

Assessing risk should simply be seen as a qualitative approach used to solve problems by utilizing tools to rank and address them.

The four phases are identification, assessment, response and the development and implementation of preventive measures to ensure it doesn’t happen again.

Related: Technology Risk Management

Risk Identification

A good way to identify threats is through brainstorming. An organization will bring together its brightest and most imaginative thinkers who will collaborate and develop various types of hazards that could endanger them.

Once this is done, each threat must be ranked based on its severity and priority level. Because mitigating every risk is extremely unlikely, prioritizing the risks with the greatest chance of manifesting themselves is the next best thing.

Risk Assessment

Traditional problem solving involves determining the problem and searching for a viable solution. However, it might be more prudent for risk assessment to identify the cause of a risk. To accomplish this, you can begin by asking what caused this to happen and how can it negatively impact our operation?

Risk Response

Once you’ve assessed and identified the most significant potential threats to your organization, you now need to identify a way of resolving them.

To do this, you will want to answer two questions: what steps should be taken to keep this from happening? What actions can be performed to ensure it doesn’t reoccur in the future?

Risk Prevention

It doesn’t do you any good to resolve a problem to have it reappear again in the future. Some threats are so onerous that if they manifest themselves a second or third time, the damage caused might be so significant that the organization never recovers.

In most cases, this means that it isn’t enough to resolve the issue once; it must be fixed permanently, which is the purpose of prevention. The best way to achieve this is by developing contingency plans which can be rapidly deployed if said threats emerge again in the future.

All too often, both individuals and organizations limit themselves to temporary measures that may alleviate the problem in the short term but do not resolve the underlying cause. Most organizations opt for this approach to save money.

However, in such cases, what usually happens is that the problem worsens until a catastrophic event occurs. At this stage, the institution is forced to spend far more money, and resources than would have been necessary had they resolved it earlier.

For example, a landlord may temporarily fix something in their tenant’s apartment to avoid costs, only to have it reoccur. Eventually, the problem metastasizes to the point where a major disaster occurs. The landlord is forced to spend a large sum of money fixing it. He might lose their tenant and rental income at the same time.

Additional Risk Management Techniques

Once an organization implements a risk management system, it can use several different techniques for mitigation. These are avoidance, reduction, sharing and retaining.

Avoidance

Although it is not realistic to avoid every possible risk, this is a goal that organizations should always work towards. The purpose of avoidance is to deflect the most significant number of threats possible to prevent the disruption and financial loss that comes from their occurrence.

Reduction

After avoiding risk altogether, the next best thing is reducing the impact of its occurrence. This means that your organization will suffer a degree of damage. Still, because you took steps to alleviate the impact, the damage won’t be as severe as it would be if you did nothing at all.

Sharing

Another option is to share the risks of a potential event occurring, distributing it across multiple participants or departments. As with reduction, some damage will be sustained, but the good news is that no one party will suffer excessively since it is shared.

A variation of this approach is distributing the risk using third party business partners or vendors. However, exposing an individual or group to risks that they are unaware of is unethical, so this method should be exercised with care.

Retaining

When an institution decides that some risks are worth it, it may accept the consequences. Such an approach is common where the expected profit is higher than the risk cost.

See also: Information Security and Risk Management: Developing a comprehensive approach

Benefits of Assessing Risk

Numerous benefits can be gained from assessing risk, the most important of which is ensuring the longevity of your enterprise.

It is also likely that you will save a significant amount of money by avoiding litigation, which often harms institutions that are not adequately prepared.

Additional benefits include:

- Establishes institutional insurance needs to reduce premiums

- Foments and secures a safe environment for clients and staff

- Protect critical assets and personnel from harm

- Shield the organization from events that threaten it or the environment

- Enhance operational stability while reducing the likelihood of litigation

Drawbacks Risk Management

While every institution needs to manage risk to some degree, drawbacks to this process must be noted. Many risk evaluation methods require the collection of vast amounts of information. Getting this data tends to be expensive and might not even be worth it.

Additionally, using data to influence decision making could have an undesired outcome should simple indicators be applied to more complex realities. Likewise, making decisions initially geared towards a small aspect might lead to unexpected results during the project.

Many organizations are now using computer software created to simulate multiple events that could endanger them.

Although such programs have become more affordable and effective in recent years, they require staff trained with extensive knowledge of interpreting the results correctly.

If such individuals are not assigned to the project, the results might be inaccurate, but even when such individuals are involved, they might not have enough time to quantify their findings.