Digital Gold Trading Platforms — Cybersecurity Challenges and Innovations

Gold has never been a risky investment. However, the way people buy and trade it has changed. Instead of calling a broker or visiting a bank, investors can now purchase fractional gold, trade tokenized assets, or move holdings between wallets. All that is possible with a few taps on their phone.

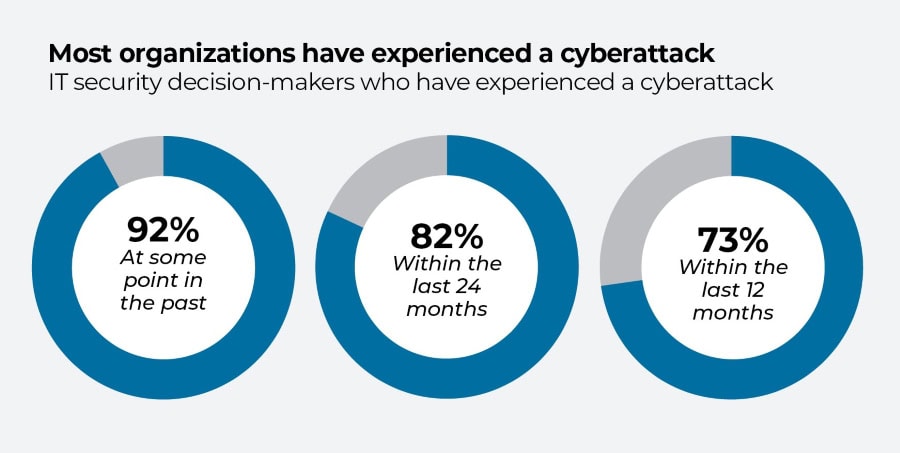

This convenience, though, comes with a catch. Digital gold trading platforms have become prime targets for cybercriminals. A single breach can drain millions and lock users out overnight.

Hackers are getting smarter. That is why platforms cannot rely on yesterday’s security playbook. So, how is the industry responding? What do business leaders and tech teams need to know to stay ahead?

On this page:

The Tech That Runs Gold Platforms & Where Things Can Go Wrong

Behind every shiny app where you can find gold trading hours and “buy gold instantly” is a stack of powerful technology. Every layer is a potential target.

Blockchain and Tokenized Gold

Many platforms are using blockchain to issue gold-backed tokens. This makes ownership more transparent but opens the door to smart contract bugs or bridge hacks. These issues can cost other crypto sectors hundreds of millions.

APIs

These platforms connect to banks, payment processors, and identity services using APIs. This approach is extremely efficient. However, every exposed API endpoint is another doorway for hackers to try.

Cloud Systems

Most digital gold companies run partly or fully on the cloud. That is a scalable and flexible solution. However, if a cloud bucket or server is misconfigured, sensitive data could leak instantly.

User Logins and Identity Checks

Two-factor authentication is a common thing now. But attackers are still finding ways around it with SIM swaps or phishing. Therefore, some platforms are experimenting with zero-trust security. They verify every user and device.

Compliance Tools

To stay on the right side of KYC and anti-money laundering rules, many platforms employ RegTech systems. These are used to scan IDs, monitor transactions, and flag shady activity. This way, they help stop fraud before it turns into a headline.

A Real-World Scenario When Hackers Test the Locks

In early 2025, several high-profile Australian superannuation funds experienced a series of automated login attacks. Hackers used previously stolen passwords to try to access member accounts. Among the victims were AustralianSuper, Rest Super, Australian Retirement Trust, Hostplus, and Insignia Financial. Here is what has happened:

- Attackers used lists of leaked credentials (from unrelated breaches) and attempted to log into accounts en masse.

- Most login attempts were unsuccessful. However, some members had accounts compromised. This has led to financial losses. Four AustralianSuper members lost a total of AUD 500,000.

- The funds responded. They alerted affected members, prompted password resets, and encouraged the use of stronger authentication methods.

This way, they have restored trust and built a system that is now much harder to breach. The lesson is easy to learn — being proactive beats cleaning up after an attack.

Lessons from Crypto, Fintech, and Banking

Digital gold platforms do not have to solve every security problem from scratch. Other industries have already paved the way.

- Crypto exchanges (Coinbase and Binance) were early hacking targets. Their fixes are now the gold standard. Multi-signature wallets, cold storage, and aggressive bug bounty programs helped them prevent big problems.

- Stock trading apps (Robinhood) learned the hard way that weak API security can lead to chaos. Their shift to stronger authentication and penetration testing is a blueprint for gold platforms.

- Banks and payment networks have perfected AI-powered fraud detection. They now scan millions of transactions for red flags. The same systems could stop a suspicious gold trade before damage is done.

Digital gold trading does not need to reinvent cybersecurity. It needs to borrow the smartest, toughest ideas already working elsewhere.

Turning Security Into a Selling Point

Security is not just about avoiding disasters. It is also about building trust. There are many reasons for investors to be cautious. They have seen exchanges hacked, wallets drained, and promises broken. When a platform says, “Here is exactly how we protect your gold,” it sends a powerful message.

That is why some platforms are making security part of their marketing strategy. They are publishing plain-language security explainers, running public audits, and hosting webinars on “How We Keep Your Gold Safe.” A platform that does not just say it is secure; it proves that. And that proof is not just good PR. It is what convinces cautious investors to sign up, stay, and grow their holdings.

Why Cybersecurity is the Foundation of Digital Gold’s Future

Digital gold trading is booming. That is why it is a prime target for cyberattacks. API weak spots, phishing scams, regulatory demands, and even the looming threat of quantum computing cracking — these are just some of the risks to mention. The good news is that there is always a solution. AI-based monitoring, zero-trust security, multi-sig wallets, and smarter compliance tools can prevent disasters.

The takeaway is simple here. Security is not a box for business leaders and IT teams to check. It is the core of your platform’s value. The solutions that treat cybersecurity as part of their DNA will do more than protect gold. They will earn something even more valuable — trust.